The Start of a Movement

It initially started as a subtle notion within the realm of responsible investing.

In 2004, a coalition of international financial entities, along with the United Nations, released a report named “Who Cares Wins,” which served as the initial push towards what we now refer to as ESG—Environmental, Social, and Governance. At that time, ESG was more of a question than a framework: Is it possible for profit to align with principles?

By 2025, this question had transformed into a clear answer supported by evidence. ESG has emerged as the key indicator of long-term value, resilience, and reputation. From Wall Street to Nariman Point, and from Riyadh to Singapore, ESG has shifted from being a desirable feature to an indispensable business requirement.

Understanding ESG

In basic terms:

-

- Environmental: How does your business impact the environment?

- Social: How does it engage with people—employees, communities, customers?

- Governance: How is it managed, how transparent is its operations, and who is accountable?

However, in practical applications, ESG is not merely a checklist. It functions as a strategic operating system that connects sustainability with shareholder value, ethics with business growth, and long-term thinking with leadership.

According to McKinsey’s Five ways that ESG creates value:

“ESG links to cash flow in five important ways: facilitating top-line growth, reducing costs, minimizing regulatory and legal interventions, increasing employee productivity, and optimizing investment and capital expenditures.”

Why ESG Has Become Essential for Boardrooms

In an era marked by pandemics, climate challenges, social upheaval, and data breaches, stakeholders seek more than just profit. They want to inquire:

-

- What is your carbon footprint?

- What is the diversity of your leadership?

- Are your suppliers ethical?

- Is your AI operation fair?

- How robust is your governance?

Here’s why ESG is gaining traction in boardrooms and terms sheets:

-

- Over $41 trillion in global ESG assets under management (Bloomberg Intelligence, 2022)

- 88% of public companies implement ESG initiatives (Navex Global Survey)

- Companies with high ESG ratings can outperform by 25% over industry average (McKinsey)

- Valuation premiums of 10-15% are attributed to ESG transparency and ratings (Ref: EY, Morgan Stanley)

Embracing ESG as a Mindset, Not Just a Report

The biggest error companies make is viewing ESG as a regulatory obligation. ESG shouldn't be a one-off workshop on Fridays; it should be integral to Monday morning strategy discussions.

In developing regions such as India, the Middle East, and Southeast Asia, ESG is shifting from mere compliance to a catalyst for growth. Consider the following examples:

-

- ESG-linked green bonds in India have tripled since 2020, with companies like Mahindra and Infosys embedding ESG into their core values—from water-positive campuses to inclusion initiatives.

- Saudi Arabia’s Vision 2030 aligns closely with ESG principles, directing over $700 billion towards clean energy, educational reform, and effective governance.

- In Singapore, Temasek connects executive bonuses to sustainability key performance indicators. Here, ESG is viewed as a measure of return on invested capital, not just corporate social responsibility.

ESG is not an accessory to capitalism. It is its driving force.

The Value-Value-Value Triangle

Value Creation

ESG enhances efficiency by delivering energy savings, transparent digital supply chains, and predictive compliance. Companies focusing on ESG can:

-

- Reduce their cost of capital by 20-30 basis points

- Increase customer loyalty (62% of Gen Z prefer sustainable brands – Deloitte)

- Attract top-tier talent (Millennials and Gen Z prioritize purpose over salary)

Value Delivery

Stakeholders now expect proficiency in ESG:

-

- 91% of institutional investors will avoid investing without a sustainability criterion (PwC Global, “How ESG reporting is moving centre stage,” April 2019)

- Supply chains are evaluated based on labour practices and carbon impact

- Customers penalize greenwashing but reward genuine efforts

Valuation Premium

Companies with strong ESG ratings receive:

-

- Up to 15% higher price-to-earnings ratios (McKinsey: The ESG Premium)

- Lowered costs for debt servicing

- Greater trust during mergers and acquisitions or initial public offerings

Formula:

ESG-Adjusted ROE = (Net Income – ESG Risk Premium) / Equity

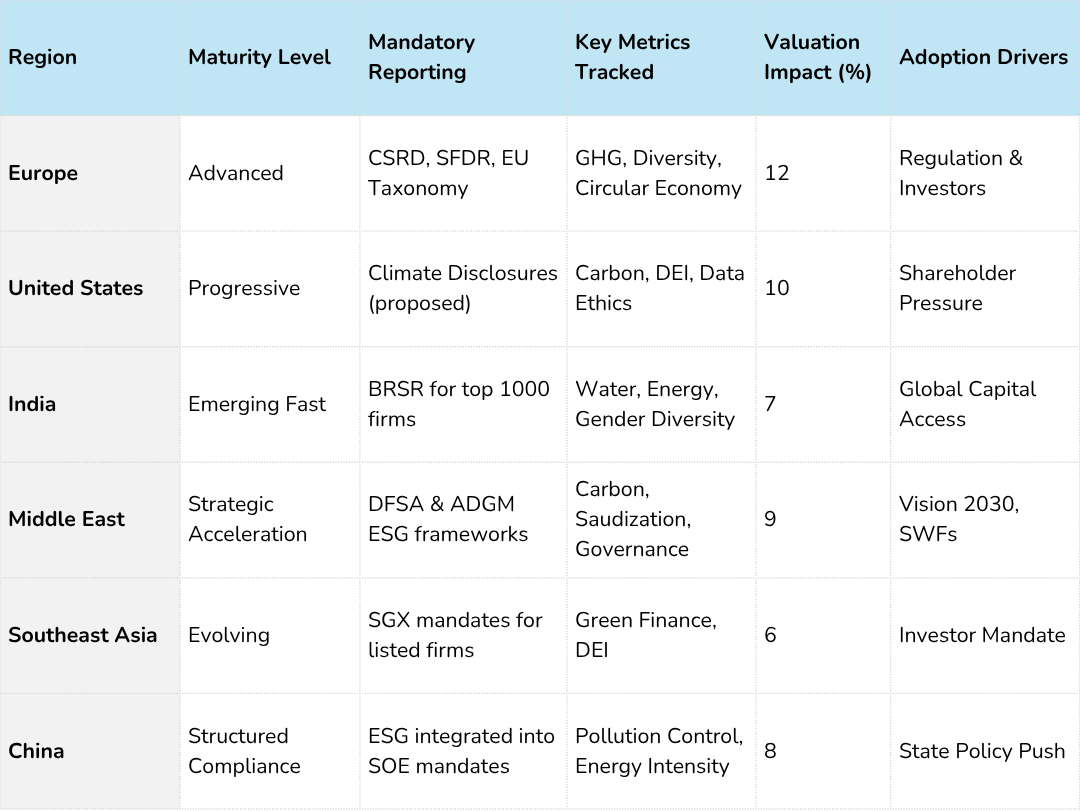

Maturity Map: Where the World Stands:

Interpreting the ESG Maturity Map

Grasping the global ESG maturity landscape involves more than mere policy comparison; it's essential to comprehend the pace, pressures, and motivations fuelling ESG adoption across different regions.

Here are three significant insights to aid in interpreting the map:

-

- Europe Takes the Lead, but Faces Challenges Europe’s progress in ESG maturity is largely propelled by regulatory mandates and active investors. Initiatives like the CSRD, SFDR, and EU Taxonomy dictate that ESG compliance is not optional; it's a requirement. However, the high costs and complexities associated with ESG can pose challenges for smaller companies, leading to a disparity in the depth of adoption across the region.

- The U.S. Is Driven by Investor Activism Rather Than Regulation

In the U.S., the rise of ESG-related investments is largely fuelled by market forces rather than regulatory frameworks, as the SEC continues to adapt. The landscape thrives on shareholder influence, social media activism, and consumer demand. However, political division can hinder ESG initiatives. - India’s ESG Path: Ambitious, Rapid, and Full of Contradictions

India represents one of the most intriguing ESG narratives globally. Although it may not possess the same depth as Europe or the investment vigour of the U.S., it is marked by urgency, innovation, and pressure from various stakeholders.

Notable features include:

-

-

- Regulatory Framework: The SEBI-enforced BRSR (Business Responsibility and Sustainability Reporting) for the top 1,000 listed entities is shifting the focus from superficial CSR to genuine ESG accountability.

- Cultural Alignment: ESG resonates with India's cultural heritage of frugality, social responsibility, and environmental stewardship, drawing from ideals such as Gandhian minimalism and grassroots sustainability initiatives.

- Obstacles: Issues like fragmented supply chains, data quality deficiencies, and varying levels of ESG understanding present significant challenges.

-

“India's ESG progress is not straightforward; it is characterized by rapid advancements. While it may lack robust infrastructure, it is rich in intent and innovation.”

-

- The Middle East: Ambitiously Visionary and Government-Led

Through initiatives like Vision 2030 and sovereign wealth funds including PIF and Mubadala, the Middle East is harnessing ESG as a strategic tool for economic rebranding, attracting international investment, and reducing reliance on oil. Here, ESG is integral to the broader economic transformation, driven from the top down by national goals. - Southeast Asia: Diverse Yet Progressing

ESG maturity in Southeast Asia varies widely. Singapore sets a regional standard due to SGX regulations and Temasek’s leadership. Countries like Indonesia and Malaysia are rapidly developing but remain largely reliant on extractive industries. In this region, capital markets are pushing ESG advancement more than local demand, though the growth momentum is clear.

- The Middle East: Ambitiously Visionary and Government-Led

For those unfamiliar with ESG, this map outlines the status of each region while also shedding light on the underlying reasons and dynamics. India's experience stands out as a significant example of high aspirations confronting intricate challenges, where ESG is evolving from merely a compliance mechanism to a competitive advantage in attracting global capital.

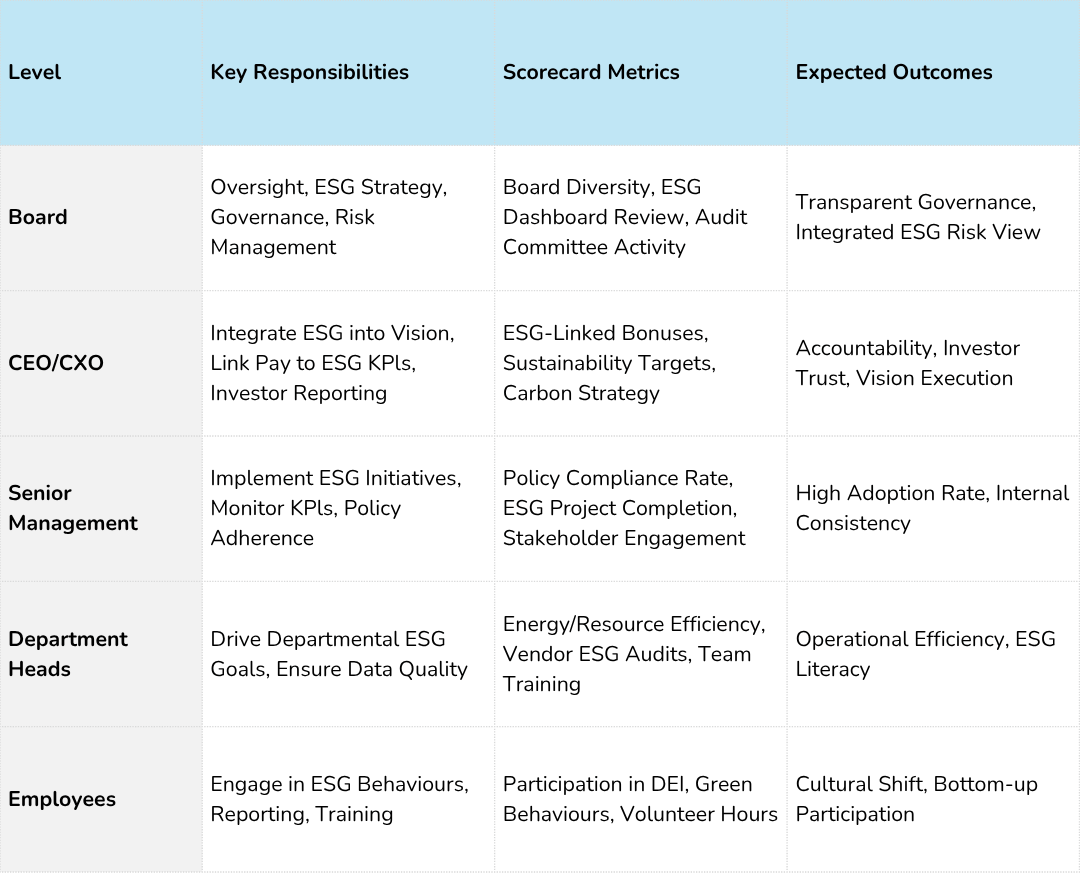

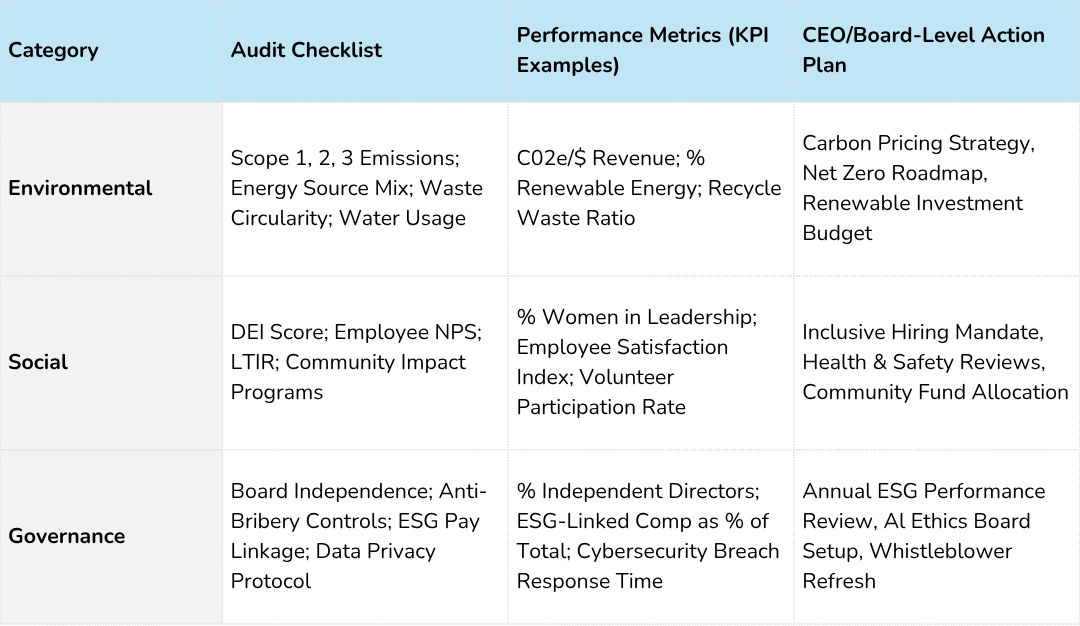

ESG at every level: A scorecard of success:

ESG Audit and Performance Evaluation:

The Conclusion — ESG as the Heart of Strategy

In 2025 and beyond, ESG stands as the most reliable measure of how prepared your business is for the future.

This commitment isn’t about appearances; it’s about being genuinely accountable in an ever-observant world.

The return on investment (ROI) of ESG transcends financial gain. It embodies a Return on Integrity.

ESG is not just a framework. It represents your unique impact—the legacy you create, the trust you nurture, and the difference you make when the spotlight is off.